On October 22, the global mineral resources strategic research center of China Geological survey released the evaluation report on global lithium, cobalt, nickel, tin and potassium mineral resources reserves (2021).

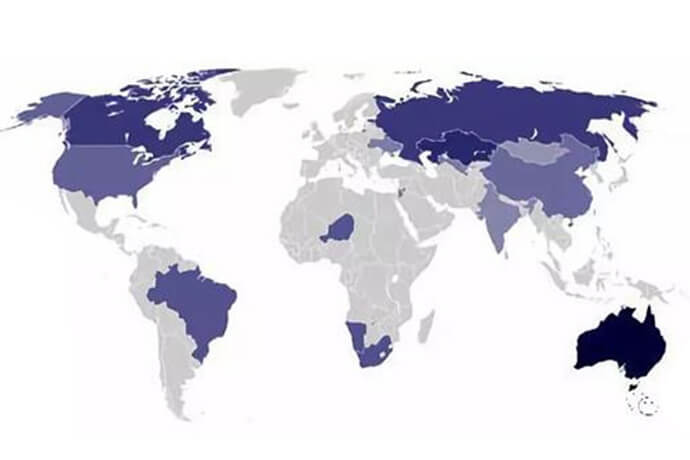

According to the data, by 2020, the global lithium ore (lithium carbonate) reserves were 128 million tons and the resources were 349 million tons, mainly distributed in Chile, Australia, Argentina, Bolivia and other countries. Cobalt reserves are 6.68 million tons and resources are 23.44 million tons. Congo (DRC), Indonesia, Australia and other countries are the most abundant. Nickel ore reserves are 90.63 million tons and resources are 260 million tons. Indonesia ranks first in the world. Australia, Russia and other countries are rich in resources. Tin ore reserves are 3.27 million tons and resources are 8.07 million tons. China, Russia, Southeast Asia and other countries and regions are the main producing areas of tin ore. Global potassium salt (potassium chloride) reserves are 12.9 billion tons and resources are 43 billion tons. The reserves of Russia, Canada, Belarus and Turkmenistan account for 80% of the world. Russia has surpassed Canada to become the largest country in potassium salt reserves.

From the consumer side, in 2020, the global consumption of lithium (lithium carbonate) is about 400000 tons, cobalt is about 170000 tons, nickel is about 2.4 million tons, tin is about 380000 tons and potassium salt (potassium chloride) is about 54 million tons. Compared with the existing reserves, the guarantee degree of global lithium, nickel and potassium resources is high, and the guarantee degree of cobalt and tin is relatively low.

Next, the China Geological Survey of the Ministry of natural resources will accelerate the establishment and improvement of the global mineral resource reserve data system and evaluation mechanism. It plans to complete the dynamic evaluation of the reserves of 40 important mineral resources in the world in five years, publish services in time, and actively contribute Chinese wisdom and strength to promoting global mining cooperation and building a global mining community of common destiny.

On the same day, the international mining research center of China Geological survey also released the global mining development report (2020-2021). The report shows novel coronavirus pneumonia outbreak, global energy resources demand overall atrophy, structural differentiation, energy and bulk mineral consumption decline, new energy consumption of mineral resources increased rapidly. In 2020, the total global energy consumption will decrease by 4.5%, the largest decline since World War II; Oil, coal and natural gas decreased by 9.5%, 3.9% and 2.1% respectively, and renewable energy such as wind power, hydropower and solar energy increased by 9.7%. Iron and aluminum decreased by 0.2% and 0.7% respectively; Copper, lithium and cobalt increased by 6.2%, 15.3% and 7.3% respectively.

The report shows that since the second half of 2020, the performance of mining companies has generally rebounded, and the revenue and market value have continued to rise. The total market value of the world's top 50 mining companies reached US $1.47 trillion, a record high. The comprehensive strength of mining giants has been further improved and the layout of copper, lithium, cobalt, nickel and other new energy minerals has been accelerated.

According to the analysis of the report, climate change promotes the transformation of human production and lifestyle to low-carbon, and the global supply and demand structure of mineral resources and mining pattern are breeding significant changes. Under the background of low-carbon economy, the growth rate of demand for traditional mineral resources has further slowed down, and the demand for clean energy and strategic emerging minerals has increased rapidly. The status of traditional energy resource suppliers such as coal, oil, iron and manganese will decline, and the status of strategic emerging mineral suppliers such as lithium, cobalt and nickel will continue to rise.

Location:

Location: